Whether you're a freelancer, consultant, or independent contractor, getting paid is a major part of running your business. But many freelancers find themselves asking: Is a bill the same as an invoice? Although both request payment, they serve different purposes, especially when it comes to timing, detail, and accounting.

This guide breaks down the difference between a bill and an invoice, explains when to use each, and provides best practices for freelancers to maintain a smooth and professional payment process.

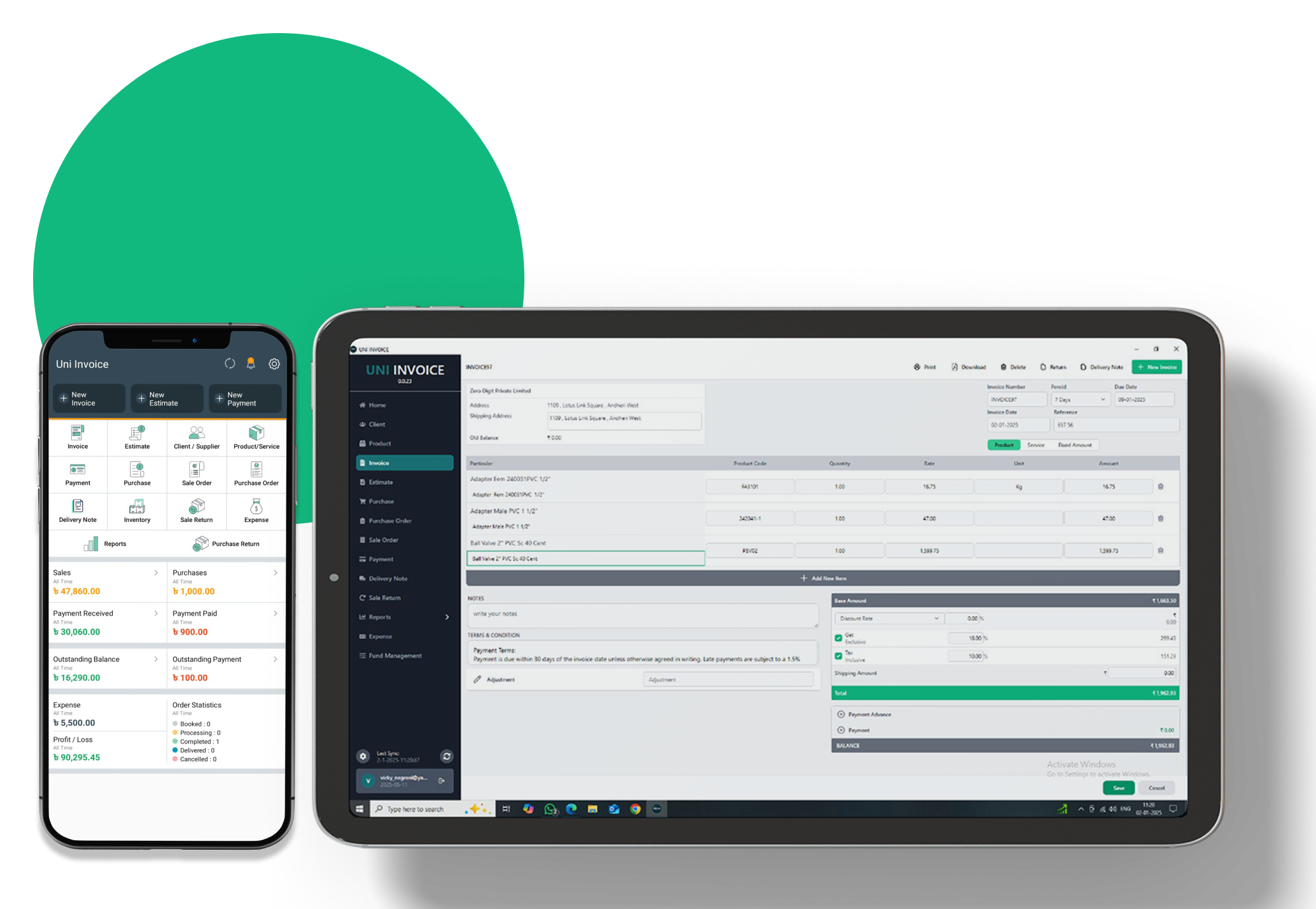

An invoice is a detailed document used to formally request payment. Freelancers and contractors typically use invoices to bill clients for completed work, deposits, or monthly services.

Common invoice elements include:

Invoices are ideal for professional services that require tracking, documentation, and clear payment timelines.

A bill also requests money from a buyer, but typically requires immediate payment. Bills are most common in point-of-sale environments such as cafés, salons, restaurants, and retail stores.

Bills are simpler than invoices and often leave out tracking details like invoice numbers or itemized breakdowns.

| Feature | Invoice | Bill |

|---|---|---|

| Purpose | Formal payment request with details | Quick request for immediate payment |

| Timing | Payment due later (e.g., 15–30 days) | Payment due immediately |

| Detail Level | Highly detailed, itemized, numbered | Minimal details, simple total |

| Best For | Freelancers, contractors, B2B services | Retail, restaurants, utilities, subscriptions |

Most freelancers should use invoices because they provide transparency, documentation, and structured payment timelines.

Use a bill when:

Use an invoice when:

Most freelancers email a PDF invoice to their client. Avoid sending editable files like Word documents.

Subject: Invoice for [Project Name]

Hi [Client Name],

Please find the invoice for [project] attached. The total due is [Amount], payable by [Due Date].

Let me know if you have any questions.

Thank you,

[Your Name]

Bills and invoices both request payment, but they serve different purposes. Understanding the difference helps freelancers stay organized, maintain professionalism, and ensure timely payments.